Financial Modeling and Valuation

Course …(February 12,2018 to february 16,2018)- Register here as individual or

group-http://bit.ly/2rn4U0T

Introduction

The course extends the core theory

introduced in Principles of Finance by emphasizing its practical application to

strategic financial decisions and potential financial problems.

Duration

5days

Who

should attend?

·

Financial Analysis

·

Business Entrepreneurs

·

Accountants

·

Bookkeepers

·

Business managers

·

Investment officers

·

Managing directors

Course

Objective:

·

Analyzing and understand an income

statement

·

Analyzing and understand a balance

sheet

·

Analyzing and understand a cash flow

·

Understanding use of financial

modeling in financial reporting

·

Use of Discounted Cash Flow (DCF) and Weighted

Average Cost of Capital

·

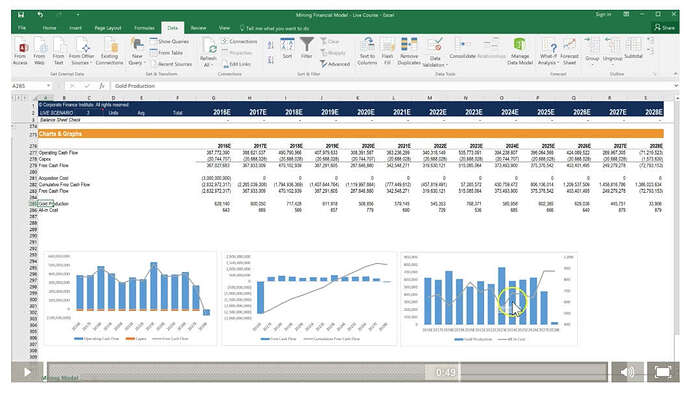

Use of excel in financial modelling

Course

content

Module 1: Valuation

Introduction

to valuation

·

The importance of valuation

·

Understanding enterprise value and

equity value

Comparable

Company Analysis

·

Selecting comparable companies

·

Spreading comparable companies

·

Analyzing the valuation multiples

·

Concluding and understanding value

Precedent

Transactions Analysis

·

Selecting comparable transactions

·

Spreading comparable transactions

Discounted

Cash Flow (DCF) analysis

·

Understanding unlevered free cash

flow

·

Forecasting free cash flow

·

Forecasting terminal value

·

Present value and discounting

·

Understanding stub periods

·

Performing sensitivity analysis

Weighted

Average Cost of Capital (WACC)

·

Using the CAPM to estimate the cost

of equity

·

Estimating the cost of debt

·

Understanding and analyzing WACC

Module

2: Building an Integrated Cash Flow Model

Introduction

to financial modeling

·

Understanding the links between the

financial statements

·

Understanding circularity

·

Setting up and formatting the model

·

Selecting model drivers and

assumptions

Modeling

and projecting the financial statements

·

Projecting the income statement

·

Projecting the balance sheet

·

Projecting the cash flow statement

·

Creating the debt and interest

schedule

·

Revolver modeling

Analyzing

and concluding the model

·

Analyzing the output

·

Stress testing the model

·

Fixing modeling errors

·

Advanced modeling techniques

·

Using the model to create a

Discounted Cash Flow (DCF) Analysis

General

Notes

·

All our courses can be Tailor-made

to participants needs

·

The participant must be conversant

with English

·

Presentations are well guided,

practical exercise, web based tutorials and group work. Our facilitators are

expert with more than 10years of experience.

·

Upon completion of training the

participant will be issued with Foscore development center certificate (FDC-K)

·

Training

will be done at Foscore development center (FDC-K) center in Nairobi Kenya. We

also offer more than five participants training at requested location within

Kenya, more than ten participant within east Africa and more than twenty

participant all over the world.

·

Course duration is flexible and the

contents can be modified to fit any number of days.

·

The course fee includes facilitation training

materials, 2 coffee breaks, buffet lunch and a Certificate of successful

completion of Training. Participants will be responsible for their own travel

expenses and arrangements, airport transfers, visa application dinners, health/accident

insurance and other personal expenses.

·

Accommodation, pickup, freight booking and

Visa processing arrangement, are done on request, at discounted prices.

·

One year free Consultation and

Coaching provided after the course.

·

Register as a group of more than two

and enjoy discount of (10% to 50%) plus free five hour adventure drive to the

National game park, in Nairobi.

·

Payment should be done two week

before commence of the training, to FOSCORE DEVELOPMENT CENTER account, so as

to enable us prepare better for you.

·

For any enquiry at:training@fdc-k.org or

+254712260031

·

Register as an Individual/ Group-

http://bit.ly/2rn4U0T

·

View Business and Governance courses

calendar 2018-2019 – http://bit.ly/2FERaSh

·

View All Courses calendar

2018-2019 -http://bit.ly/2mB2p5w

·

Course Fee:KES:70000|USD:1000|EURO:900|POUND:800